Company profile

Our services

- International transit of natural gas across the Czech Republic

- National transmission of natural gas to our partners in the Czech Republic

- Operation of a flexible, demand-oriented transmission system, and the provision of associated commercial and technical services

NET4GAS at a glance

- Holds an exclusive gas Transmission System Operator (TSO) license in the Czech Republic

- Operates more than 4,000 km of pipelines

- Operates three border transfer stations, five compressor stations and a hundred transfer stations at the interface with domestic gas distribution

- Is a member of the Czech Gas Association, the international organisations ENTSOG, GIE, EASEE-gas and the IGU and Marcogaz working groups

- Has more than 500 employees

- Is one of the largest private corporate donors to nature conservation in the Czech Republic.

- Is committed to its corporate social responsibility

Our strategy

Our mission

Our mission is to secure economically efficient, safe and reliable gas transmission services for our customers 24 hours a day, 7 days a week, and to provide sufficient capacities in all relevant supply situations based on a non-discriminatory and transparent approach.

Our vision

As a Central European gas Transmission System Operator, NET4GAS will play an active role in connecting and integrating European energy markets to the benefit of Czech and other European customers.

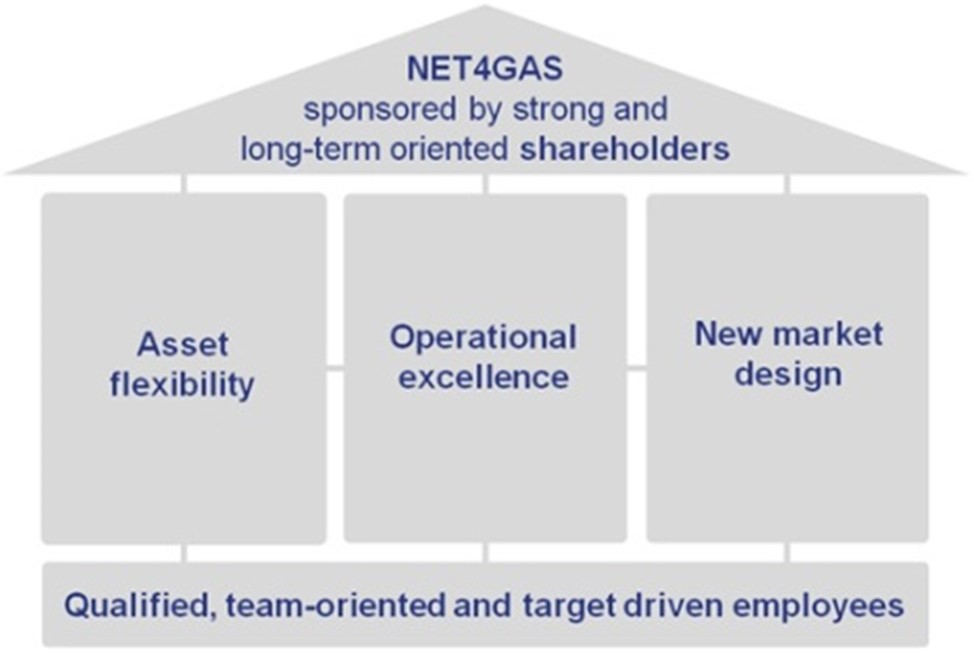

Highly qualified employees are our company’s foundation stone and most valued resource. Their team-oriented work and target-driven approach are major factors in the company’s continuous development, which is clearly focused on the three strategic pillars of asset flexibility, operational excellence and new market design.

Along with the range of attractive capacity products we offer our customers, enhancing our asset flexibility by building and optimising new and existing cross-border interconnectors allows us to swiftly respond to changing gas flow patterns in Europe, while strongly supporting further market integration.

We strive for operational excellence to meet our customers’ expectations and to manage the financial and operational demands resulting from increasing fluctuations in grid utilization, regulation and growing competition on energy markets.

We will continue to help shaping the European energy market in the context of the transition to a low carbon economy, and by doing so will contribute to the preservation and enhancement of functioning gas markets, especially in Central and Eastern Europe where we operate.

In achieving our vision and attaining our strategic goals, we receive major sponsorship from our strong and long-term oriented shareholders, who thus safeguard the fulfilment of our company strategy.

We are also fully aware of our corporate social responsibility, and we strictly follow an environmental policy committed to both present and future generations.

Our owner

NET4GAS is wholly owned by NET4GAS Holdings, s.r.o., which in turn is owned by ČEPS, a.s.

Downolads